- 10 percent annual sales growth over a business cycle

- 14 percent adjusted EBITA margin

- 15 percent return on operating capital

- Dividend corresponding to 30-50 percent of net profit after tax

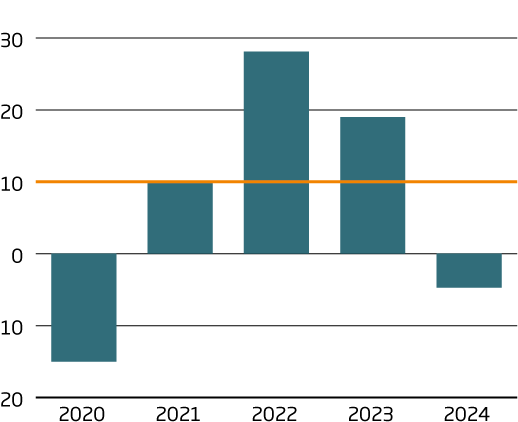

Sales growth, %

Annual sales growth over a business cycle is to amount to 10 percent. During 2024, sales decreased by 4.7 percent. Average annual growth during the past five years was 6.5 percent.

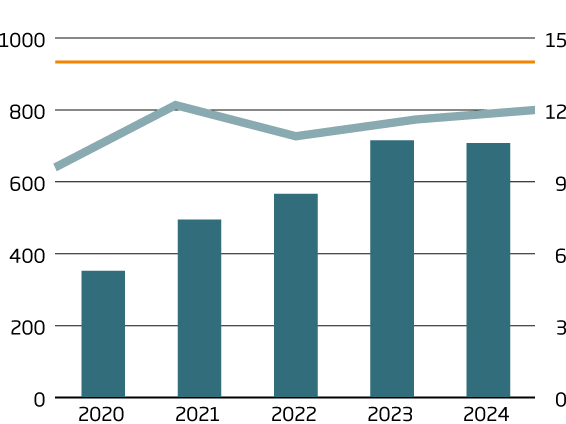

Adjusted EBITA and adjusted EBITA margin

■ Adjusted EBITA, SEKm ■ Adjusted EBITA margin, %

Adjusted EBITA margin is to amount to a minimum of 14 percent. In 2024, the adjusted EBITA margin was 12.0 percent.

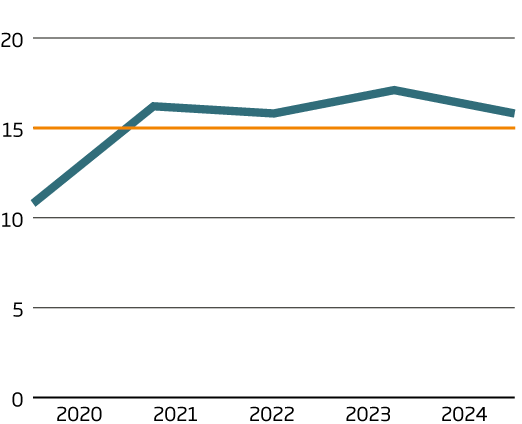

Return on operating capital, excluding IFRS. 16, %

The return on operating capital is to be at least 15 percent. In 2024, the return was 15.8 percent.